Mark L. Sirower and Jefferey M. Weirens have written an delightful book on the end-to-end M&A journey that in less than 320 pages conveys the key concepts for doing the right deal and doing it right. The two senior advisors, representing Deloitte’s M&A and Financial Advisory practices, have more than 50 years of deal experience in between them.

A brief summary of the "acquisition game" and the history of acquisitions establish the WHY this book is needed. Simply put, the reason this book and so many others on M&A exist is that companies keep doing disappointing M&A journeys. Data presented in the book show that ~56% of deals in the period 2012-2018 failed to achieve positive returns (an improvement of the 1990s where data indicates 65% of deals failed and far off the common myth that 70-90% fail). After fairly arguing for the need of yet another M&A bible the book structures its message with the overall M&A experience in mind.

The journey starts with a chapter on M&A strategy. You have to know what you want and WHY. "Prepared acquirers" don't get cornered into deals by bankers or get caught into a CEO “ego trip". They have a portfolio of targets and if one deal doesn't fit the bill they move on. Simon Sinek, the author, is right to push the message – “Start with Why”. If you are depending on others to act on any of your decisions make sure you have a solid WHY and make sure you effectively communicate it. In M&A others will act upon a deal decision. Investors act fast with their decisions to buy or sell once a deal is announced, employees act with their decisions to stay or leave and all other stakeholders act in their perceived best interests.

The journey continues with a target being evaluated in due diligence (DD) where the authors give a brief overview of three critical assessments:

Although explicitly excluded due to "complex nature of their assessments" the book would benefit from including at least a summary of the two other critical operational assessments ITDD and HRDD. I have seen these been performed separately as standalone assessments more often than included as part of an Operational DD. They deserve attention if an acquirer wants to do their diligence homework.

A good portion of the book is dedicated to valuation and how to ensure the premium an acquirer is willing to pay can be motivated (and then some) by identified synergies. The authors emphasize the use of Economic Value Added (EVA) calculations as complementary tool and sanity check for the traditionally used Discounted Cashflow Analysis (DCF) of valuation. The chapter highlights in a illustrative way, with real cases, how market value calculations based on EVA (current operations value + present value of future EVA improvements) can provide a good overview over what the acquirer is promising its investors.

"Once an acquirer closes a deal, they have fixed the price of the target and the only price that will fluctuate is the acquirer's starting right at the announcement based on the offer price."

Throughout the book the authors keep reminding the reader that the promise of synergies, for which the acquirer pays a premium, must be thought of as improvements that result from the deal. Only from the deal. That is, synergies should be operating gains beyond any stand-alone expectations (e.g. already planned cost reductions of 5% over the coming 2 years at target should not find their way into the synergies).

It is worth repeating. The suggested market value model show just how much those future EVA improvements need to grow from the stand-alone case when you pay a premium.

With a solid strategy, professional due diligence and proper valuation the successful acquirer should have reason to celebrate at announcement day. More often than not this is not the case. The book argues that investors can see through the strategy and valuation in seconds. They will be looking for if the premium paid is complemented with credible plans for synergy realization. Investors thereafter react rapidly - by selling or buying shares. A Deloitte study of more than 1200 deals spanning +20 years show that an initial negative reaction on announcement day is likely to be superseded by months and years of low stock performance.

Three chapters are dedicated to the art of integration. This critical part of the M&A journey can wreck a perfectly good deal if not performed correctly. Most often integrations stumble because the previous steps in the journey were suboptimal. Retakes on integrations 2-3 years after close are not unfortunately not uncommon.

Why call this part critical? This is where WHY becomes WHAT, HOW, WHO and WHEN. There are often up to "10 000 non-routine decisions" to be taken during an integration over its three overarching phases: Pre-Close, Day 1 and Post Day 1. Decisions require governance, which can easily be established, but decision making in the long run is primarily facilitated by a clear deal strategy and integration blueprint. In addition, taking key decisions early pre-close and clearly communicate them will save time further down the road. Examples of such decisions include:

We have all read numerous quotes on the importance of plans ("they are useless but planning is indispensable" or "everyone has a one until they get M&A punched in the face"). The task of merging two companies is no small feat and will require planning, execution, control and change management at a level neither company is used to facing. The Synergy Solution puts forward three core objectives with integration planning:

The book strongly argues for making the integration effort the absolute key internal project of both companies. WHO integrates thus becomes important not only from an operational perspective but also as a communication of intent. Put a strong established senior leader at the helm of the integration management office (IMO) and data and decisions will flow much better than if you go for the easier options (e.g. taking someone internally with time or an outside advisor). I have experienced both situations as an advisor - the role of integration lead and the role as an advisor to the integration lead. In my view, neither M&A experience, nor intellect nor project management wizardry can compensate for a) in depth knowledge of the company’s operating model and b) the respect a senior leader commands in her/his organization. If the program is large or the acquirer inexperienced the support of advisors will add great value in execution and control.

The journey ends with a set of tools to prepare a board of directors for a successful M&A experience. Interesting perspectives on shareholder value at risk and eye-opening data on the significant underperformance of all-stock-deals in comparison to all-cash-deals.

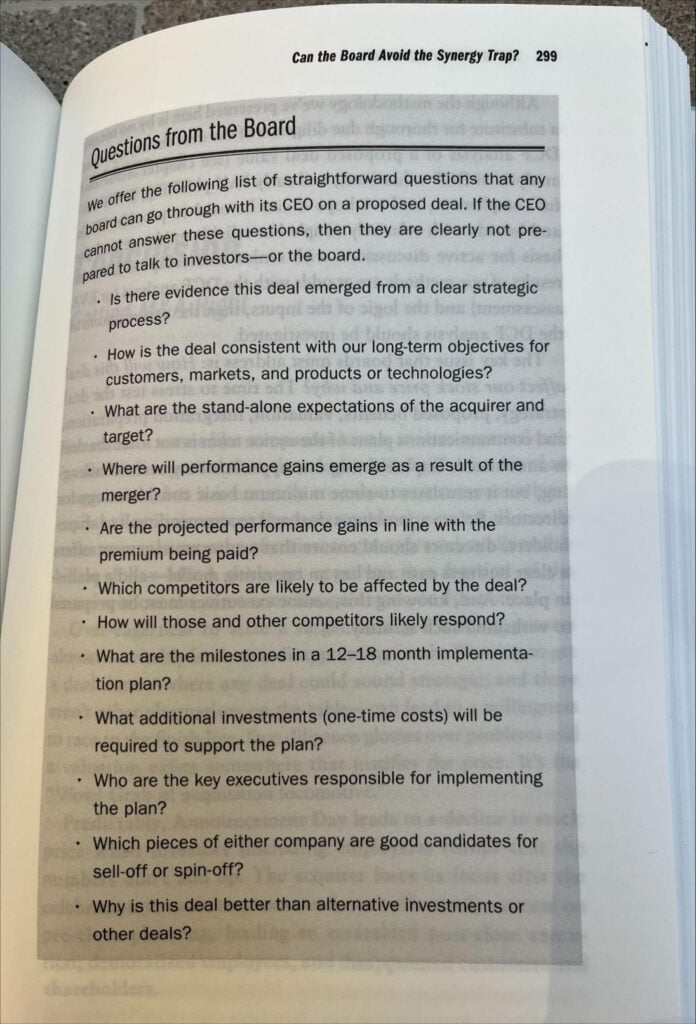

Nonetheless, some of the tools recommended, e.g. meet the premium line, capabilities/market access risk and synergy mix, fit better in the valuation chapter. Strategy, due diligence and valuation/synergies ensures “the right deal” is done. The board will rely on all of these for their vote. They will also want to see a solid plan for “doing it right”. The authors present a list of questions for the board to consider that are worth repeating (see image below).

The book closes out with a chapter summarizing the M&A experience and previous chapters. Always helpful. I enjoyed reading this book and can strongly recommend it to executives, board members and professional or vocational students of M&A.